Pergunta

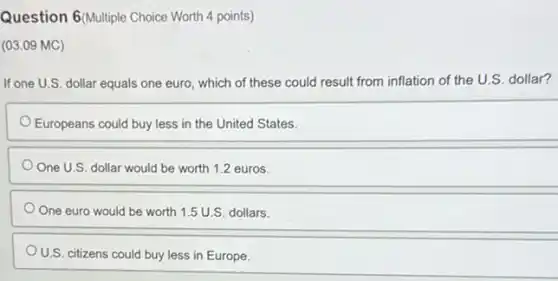

Question 6(Multiple Choice Worth 4 points) (03.09 MC) If one U.S. dollar equals one euro, which of these could result from inflation of the U.S dollar? Europeans could buy less in the United States. One U.S. dollar would be worth 1.2 euros. One euro would be worth 1.5 U.S. dollars. U.S. citizens could buy less in Europe.

Solução

Verification of experts

Verification of experts4.0260 Voting

Renata MariaMestre · Tutor por 5 anos

Responder

'Europeans could buy less in the United States.'

Explicação

## Step 1

Inflation refers to a general increase in prices and a decrease in the purchasing value of money. In this case, if the U.S. dollar experiences inflation, it means that the value of the U.S. dollar decreases relative to other currencies, such as the euro.

## Step 2

Given that one U.S. dollar equals one euro, if the U.S. dollar experiences inflation, it means that the same amount of U.S. dollars can now buy less than before. This is because the purchasing power of the U.S. dollar has decreased.

## Step 3

Therefore, the correct answer is "Europeans could buy less in the United States". This is because, with the same amount of euros, Europeans can now buy fewer goods and services in the United States than before, due to the decrease in the purchasing power of the U.S. dollar.

Inflation refers to a general increase in prices and a decrease in the purchasing value of money. In this case, if the U.S. dollar experiences inflation, it means that the value of the U.S. dollar decreases relative to other currencies, such as the euro.

## Step 2

Given that one U.S. dollar equals one euro, if the U.S. dollar experiences inflation, it means that the same amount of U.S. dollars can now buy less than before. This is because the purchasing power of the U.S. dollar has decreased.

## Step 3

Therefore, the correct answer is "Europeans could buy less in the United States". This is because, with the same amount of euros, Europeans can now buy fewer goods and services in the United States than before, due to the decrease in the purchasing power of the U.S. dollar.

Clique para avaliar: